The Difference Between Advised and Non-Advised Individuals

Having the right life insurance can give people the confidence to plan and achieve their life goals, while knowing that if the worst should happen, they’re protected.

Often people are confused around insurance, what they have in place and what they’re covered for.

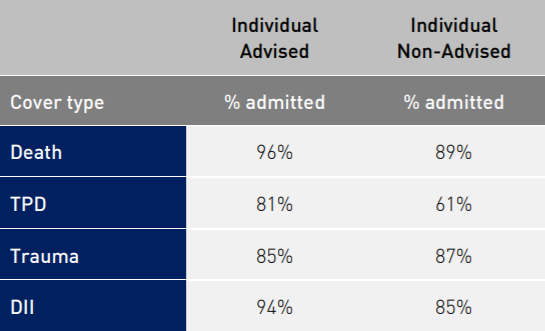

Did you know that a recent report commissioned by APRA found that people who received advice when taking out insurance are more likely to receive payment when they lodge a claim, than non-advised people?

The recent report by APRA shows that generally, individual advised business shows higher admittance rates than individual non-advised for the same cover type.

The following table breaks down some of these findings:

Due to these findings, we cannot stress highly enough, the importance of having your insurance reviewed and or implemented by a Financial Planner.

This is particularly important as an expert adviser will be able to:

- recommend the insurance cover that is right for you and your circumstances

- provide you with a clearer understanding and expectation up front of what is covered by the insurance product

- discourage you from lodging a claim that is not covered by the policy, therefore preventing the stress and heartache of having a claim rejected

If you need expert advice on insurance and the types of cover that may suit your individual needs, please don’t hesitate to contact our office on 1300 187 358 and speak with an adviser today.