The 2021-22 Federal Budget: Highlights and Key Measures

Our expert analysis and review of the latest Federal Budget.

If you missed our recent Federal Budget 2021-22 Review Webinar, please click here to access it.

We recently teamed up with Judge Accountants to discuss the key measures recently announced in the 2021-22 Federal Budget. In this article, we will cover off on the following topics:

- Superannuation

- Taxation

- Social security

- Aged care

- Housing

Superannuation

Relaxing the work test requirement

It is expected that from 1 July 2022, individuals aged 67 to 74 will not be required to meet the work test in order to make non-concessional contributions and salary sacrifice contributions to superannuation. The work test will still be required to make personal deductible contributions to super.

The work test requires clients to have been gainfully employed for at least 40 hours in 30 consecutive days during the financial year of the contribution.

The work test exemption still applies for clients with total super balances of less than $300,000.

The announcement states that individuals aged 67 to 74 will also be able to access the non-concessional bring-forward arrangement.

Currently, clients under age 65 on 1 July 2020 are eligible for the bring-forward rule. The proposal to increase the eligibility age from under age 65 to under age 67, effective 1 July 2020 remains stalled in Parliament.

Eligibility for downsizer super contributions from age 60

It is expected that from 1 July 2022, the eligibility age for downsizer super contributions will reduce from at least age 65 to at least age 60.

Downsizer super contributions allow clients to contribute up to a maximum of $300,000 (for each eligible member of a couple) to superannuation but cannot exceed the total proceeds from the sale of the home.

Downsizer contributions can be made despite the member’s total super balance, work status and there is no maximum age. There are no changes to the other eligibility criteria for downsizer super contributions.

Removal of the $450 per month superannuation guarantee income threshold

It is expected that from 1 July 2022, the Government will remove the current $450 per month minimum income threshold, under which employers do not have to pay the superannuation guarantee for employees.

This measure will improve equity in the superannuation system by expanding the superannuation guarantee coverage for clients with lower incomes and those who have casual positions with multiple employers.

The Retirement Income Review estimates that by removing this threshold, approximately 300,000 individuals will receive additional superannuation guarantee payments each month, of whom 63% are women.

There was no mention in the Budget of any other changes to the superannuation guarantee. Accordingly, the currently legislated increase to 10% from 1 July 2021 will go ahead.

Changes to the First Home Super Saver scheme

It is expected that from 1 July 2022, the maximum amount of voluntary contributions that can be released from superannuation under the First Home Super Saver (FHSS) scheme will increase from $30,000 to $50,000.

Under the FHSS scheme, voluntary concessional and non-concessional contributions made on or after 1July 2017 may be released from superannuation to help a member purchase their first home.

Currently, clients can release up to $15,000 of voluntary contributions from any one financial year, up to a total of $30,000 in contributions across all financial years, plus earnings on those voluntary contributions.

Under the proposed amendments, clients will be able to release up to $15,000 of voluntary contributions from any one financial year, up to a total of $50,000 contributions across all financial years, plus earnings.

The Government also announced four technical changes which will apply retrospectively from 1 July 2018. These will be introduced to help FHSS scheme applicants who make errors on their FHSS scheme release applications. The Commissioner of Taxation’s discretion to amend and revoke FHSS scheme applications will be increased. Applicants will be allowed to withdraw or vary their applications before they receive a FHSS scheme release. Those who withdraw their applications may reapply for FHSS scheme releases in the future.

The Commissioner of Taxation will be able to return any released FHSS scheme money to superannuation funds where the amount was not released to the applicant. The amount returned will be non-assessable non-exempt income to the fund and will not count towards any contribution caps.

Legacy retirement product conversions

The Government will allow individuals to exit a specified range of legacy retirement products, together with any associated reserves, for a two-year period. The two-year period will be the two full financial years after the legislation is passed.

This measure will apply to market-linked pensions (term allocated pensions), life-expectancy pensions and lifetime pensions which commenced prior to 20 September 2007. This election is voluntary, so members may choose to retain their legacy pensions. This option will not apply to flexi-pensions or lifetime pensions in Australian Prudential Regulation Authority (APRA)-regulated defined benefit funds or public sector defined benefit schemes.

Lifetime and life expectancy pensions have not been able to be commenced for over 15 years (since January 2005) SMSFs and SAFs. In many instances these products no longer provide appropriate or suitable outcomes for members.

There won’t be any grandfathering of social security or taxation treatment for the new pensions. Any commuted reserves will not count towards the individual’s concessional contributions cap. However, these will be taxed as an assessable contribution at 15%.

There will be no changes to the current method of calculating the transfer balance cap debit that applies on commutation. The standard transfer balance cap requirements will apply for any individuals who wish to use the commuted pension amount to commence an ordinary retirement phase account-based pension.

Relaxing residency requirements

It is expected that from 1 July 2022, the Government will relax residency requirements for SMSFs and SAFs by extending the central management and ‘control test safe harbour’ timeframe from two years to five years for SMSFs. In addition, the ‘active member test’ will be removed for both SMSFs and SAFs.

This measure will allow SMSF and SAF members to continue to contribute to their superannuation fund whilst overseas. In the past, the residency rules have required members who move overseas to contribute to a large retail, industry, public sector or corporate fund, which does not align with the Government’s intention to reduce the number of multiple funds individuals have.

Transfer of superannuation to the KiwiSaver Scheme

The Government will provide the Australian Taxation Office (ATO) with $11 million over four years from the 2021/22 financial year and a further $1 million per year ongoing to administer the transfer of unclaimed superannuation money directly to ‘KiwiSaver’ accounts (the New Zealand equivalent of Australian superannuation funds).

Stronger consumer outcomes for super fund members

The Government will provide $11.2 million over four years from the 2021/22 financial year and a further $3.1 million per year ongoing, to support stronger consumer outcomes for members of superannuation funds by providing:

- $9.6 million to APRA to supervise and enforce increased transparency and accountability measures as part of the Government’s ‘Your Future, Your Super’ reform, designed to ensure the superannuation system delivers better outcomes for members.

- $1.6 million to advocacy organisation, Super Consumers Australia, to act as the people’s advocate for reform in the superannuation sector to drive better outcomes for all superannuation fund members. The funding for this initiative will be met partially through an increase in levies on regulated financial institutions.

Early release for victims of family and domestic violence

The Government will not proceed with a previously announced measure to extend the early release of superannuation to victims of family and domestic violence.

Taxation

Retention of the low and middle income tax offset

The low and middle income tax offset (LMITO) is proposed to be extended for the 2021/22 financial year.

Currently, the last financial year it is available is 2020/21. The LMITO provides a tax offset of up to $1,080 for individuals or $2,160 for a couple. The maximum tax offset of $1,080 is available to clients with a taxable income between $48,000 and $90,000 per annum. See the table below for offset amounts based on an individual’s taxable income.

Low and middle income tax offset

Temporary full expensing extended to 30 June 2023

The ability for businesses with aggregated annual turnover or total income of up to $5 billion to be able to expense depreciable assets has been extended to 30 June 2023.Eligible businesses will be able to deduct the full cost of eligible assets incurred between 7:30pm (AEDT) on 6 October 2020 and 30 June 2023 (previously until 30 June 2022).

The Government confirmed all other elements remain unchanged. This means for temporary full expensing, the depreciating asset must be:

- new or second-hand (if it is a second-hand asset, aggregated turnover must be below $50 million)

- first held at, or after, 7.30pm (AEDT) on 6 October 2020

- first used, or installed ready for use, between 7.30pm (AEDT) on 6 October 2020 and 30 June 2023.

Temporary loss carry-back

The temporary loss carry-back have been extended by one year. This entitles eligible companies to carryback tax losses from the 2022/23 financial year to offset previously taxed profits in a prior financial year starting from the 2018/19 financial year through to the 2021/22 financial year.

To be eligible, companies may only have an aggregated annual turnover of up to $5 billion. Currently, companies that have incurred a tax loss in 2019/20, 2020/21 and 2021/22 can carry back losses to an earlier financial year. This proposal will extend the scheme to the 2022/23 financial year.

Employee share schemes

Removing the deferred taxing point on ceasing employment

The Government is proposing to remove ceasing employment as a taxing point for tax-deferred employee share schemes (ESS) from 1 July, following the passing of legislation.

Shares or options provided to employees at a discount under a tax-deferred employee share scheme have deferred taxing points if certain criteria are met. Rather than include the discount in the year the shares or options are acquired, the employee can currently defer the taxing point until the earliest of:

- ceasing employment

- when there is no risk of forfeiture and no restrictions on disposal (and in the case of options, when the employee exercises the option)

- 15 years.

As a result of the change, tax on the amount assessed (equal to the market value less the cost base) is deferred until the financial year in which the earliest of the last two taxing points occurs, potentially extending the period before tax is due on the amount.

Reducing the regulatory burden on employers

The Government also proposes to reduce the regulatory burdens on employers offering ESS by:

- removing disclosure requirements, exempting the offer from licensing, anti-hawking and advertising prohibitions for ESS, where employers do not charge or lend to employees to whom they offer ESS

- increasing the value of shares to access streamlined regulatory requirements for unlisted companies that charge or lend to their employees under their ESS from $5,000 to $30,000 per employee per year.

The regulatory changes will apply three months after the passing of legislation.

Modernising tax residency for individuals

The Government is proposing to simplify the individual tax residency rules, replacing the existing ‘resides’ test with a ‘183-day’ test, based on a Board of Taxation review. This test is similar to residency tests in place for New Zealand and the United Kingdom.

Under this test, anyone who is physically present in Australia for at least 183 days during a financial year will be taken to be an Australian tax resident. If this test is not satisfied, there are expected to be additional tests that will use both physical presence in Australia and other measurable, objective criteria.

Whilst not addressed in the Budget itself, the 2019 Board of Taxation report on individual tax residency proposed a secondary test based on having a 45 days presence in Australia and satisfying two of four objectively measured factors relating to:

- the right to reside in Australia

- Australian accommodation

- Australian family

- Australian economic connections.

Simplifying self-education expense deductions

The Government has proposed to simplify self-education expense deductions by removing the exclusion for the first $250 from being a deduction – unless offset against other non-deductible expenses incurred in relation to the study. This change will allow individuals to claim the full amount of any self-education expenses incurred in a financial year without needing to keep records of related non-deductible expenses.

This measure will become effective from the 1 July following the passing of legislation.

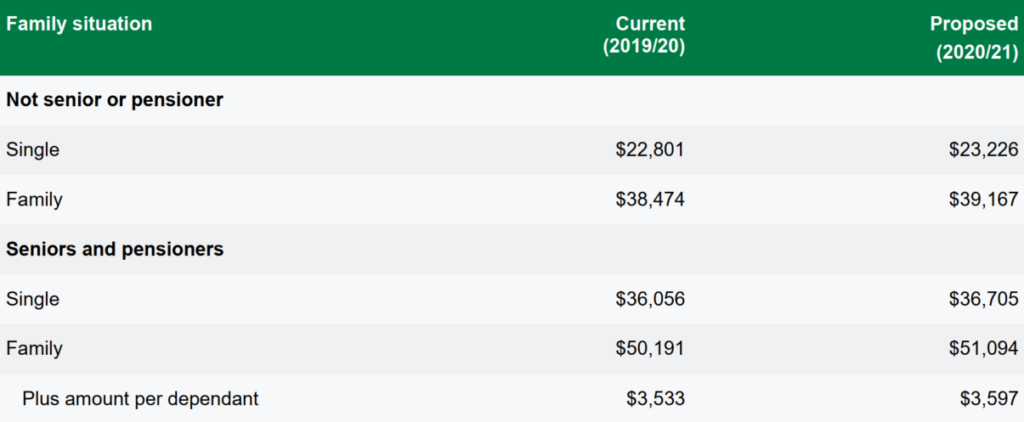

Indexation of Medicare levy thresholds

The Government is proposing to increase the Medicare levy thresholds for singles, families, seniors, and pensioners from 1 July 2020.

The updated thresholds are as follows:

Continued freezing of Medicare levy surcharge thresholds

The Government has proposed to maintain the current Medicare levy surcharge thresholds for the 2021/22 and 2022/23 financial years, whilst the Medicare levy surcharge policy is under review.

Extension of FEE-HELP loan fee exemption

The Government has proposed to extend the current exemption to the 20% loan fee for FEE-HELP loans (a loan scheme to assist eligible students to pay their higher education fees) to 31 December 2021 to encourage students to continue studying. We expect this to apply to any eligible courses that students enrol in before this time.

Social security

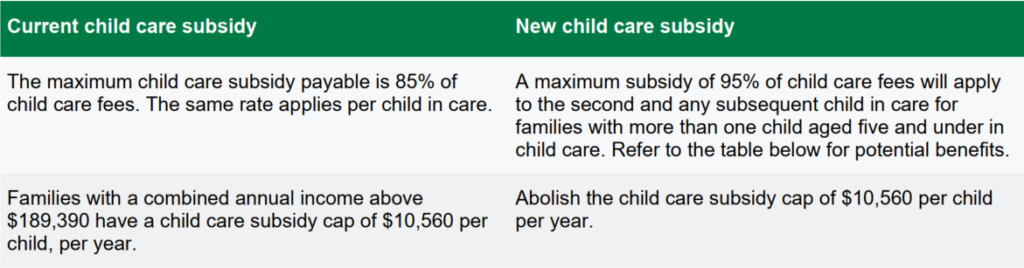

Increased child care subsidies

From 1 July 2022, child care subsidies paid to approved child care providers will increase, further reducing the cost of child care fees for families.

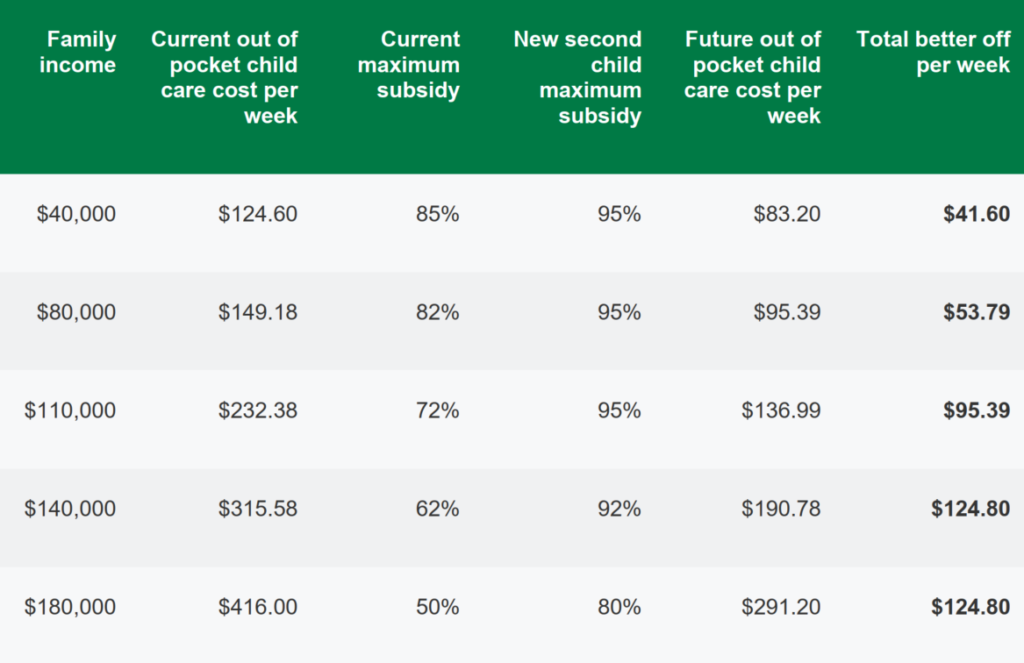

Benefit for families with two children in child care for four days

*Based on average hourly centre-based day care rate of $10.40 per hour for a 10-hour session.

Source: ‘Making child care more affordable and boosting workforce participation’, Media Release, The Hon Josh Frydenberg MP (Treasurer of the Commonwealth of Australia), 2 May 2021.

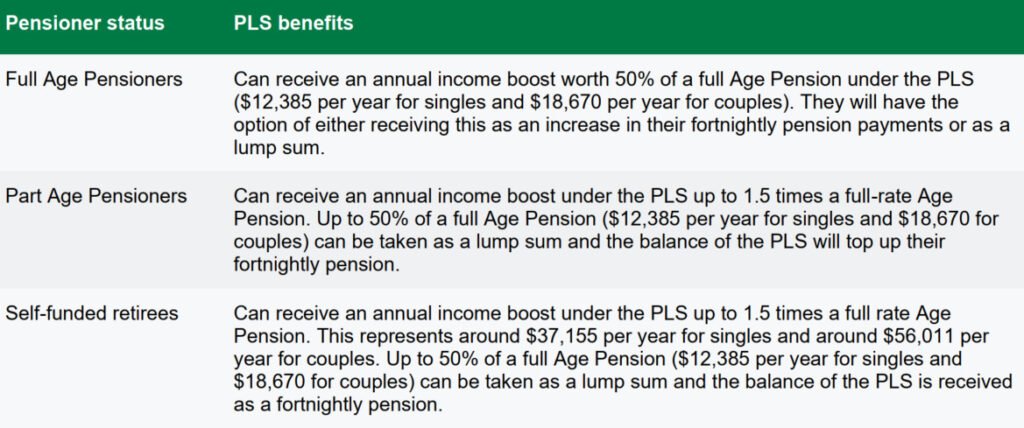

Improvements to the Pension Loan Scheme

Accessing lump sums

From 1 July 2022, clients will be able to access lump sum advance payments from the Commonwealth under the Pension Loan Scheme (PLS). Up to 50% of the maximum annual rate of Age Pension can either be paid as a single lump sum or two instalments within a year.

Currently, the PLS allows combined pension and loan payments up to 1.5 times the maximum pension rate, paid fortnightly. It doesn’t allow access to lump sums. To qualify, your client or their partner must own real estate in Australia that can be used as security for the loan.

Benefits from 1 July 2022 are illustrated following:

No Negative Equity Guarantee

A ‘No Negative Equity Guarantee’ will mean that borrowers under the PLS, or their estate, will not owe more than the market value of their property, in the rare circumstances where their accrued PLS debt exceeds their property value.

Aged care

Improving aged care

The Government’s response to the Royal Commission into Aged Care Quality and Safety is a five-year reform plan based on the following five pillars:

1. Home care: at home support and care based on assessed needs

- An additional 80,000 Home Care Packages over two years. 40,000 packages are to be released in 2021/22 and 40,000 in 2022/23, which will make a total of 275,598 packages available to senior Australians by June 2023.

- Design and plan a new in-home support care program which better meets the needs of senior Australians.

2. Residential aged care services and sustainability: improving service suitability that ensures individual care needs and preferences are met

- Support to aged care providers to deliver better care and services, including food, through a new government-funded basic daily fee supplement of $10 per resident per day.

3. Residential aged care quality and safety: improving access to and quality of residential care

- Introduction of a new star rating system to highlight the quality of aged care services.

4. Workforce: growing a larger, more highly skilled, caring and values-based workforce

- Create a single assessment workforce to undertake all assessments that will improve and simplify the assessment experience for senior Australians as they enter or progress within the aged care system.

5. Governance: new legislation and stronger governance

- The drafting of an updated Aged Care Act to enshrine the reforms, due to be in legislation by mid2023.

- Establish new governance and advisory structures, including a National Aged Care Advisory Council and a Council of Elders to work towards establishment of an office of the Inspector-General of Aged Care.

Housing

Extension of First Home Loan Deposit Scheme

The Government has proposed two extensions to the First Home Loan Deposit Scheme, whereby the Government provides a guarantee to eligible first home buyers allowing them to purchase a home with a deposit as little as 5%, without the need to pay lender’s mortgage insurance.

Family Home Guarantee

From 1 July 2021, 10,000 guarantees will be made available over four financial years to single parents with dependants. This will allow eligible individuals to build a new home or buy an existing home with a deposit of 2%, subject to the individual’s ability to service a home loan.

It will be available to both first home buyers and previous owner-occupiers. Applicants must be Australian citizens, at least 18 years of age and have an annual taxable income of no more than $125,000.

New Home Guarantee

From 1 July 2021, 10,000 places will be provided under the New Home Guarantee. First home buyers seeking to build a new home or purchase a newly-built home will be able to do so with a deposit of as little as 5% (lenders criteria apply) and not be subject to Lenders’ Mortgage Insurance because of guarantees provided by the Government.

First Home Super Saver scheme

The Government also announced it will increase voluntary contributions that can be released under the First Home Super Saver scheme (refer to the Super section for additional information on this measure).